How to file sales tax returns in the US

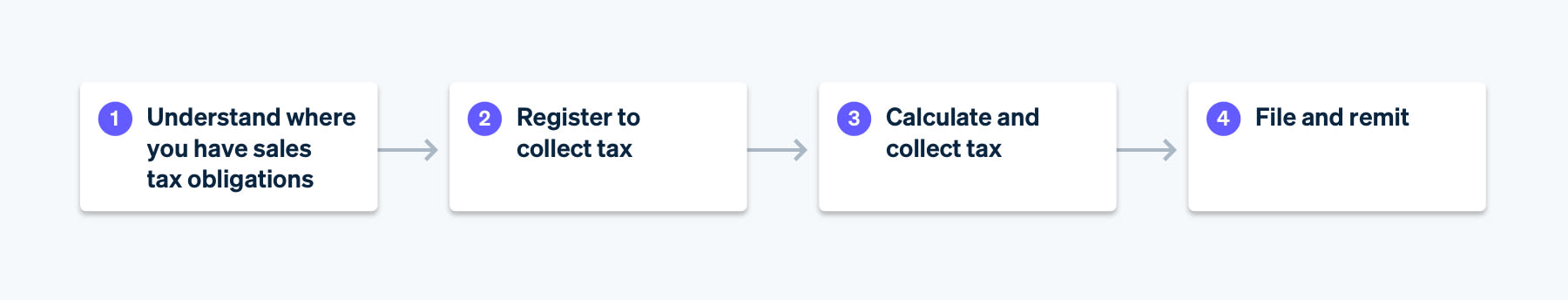

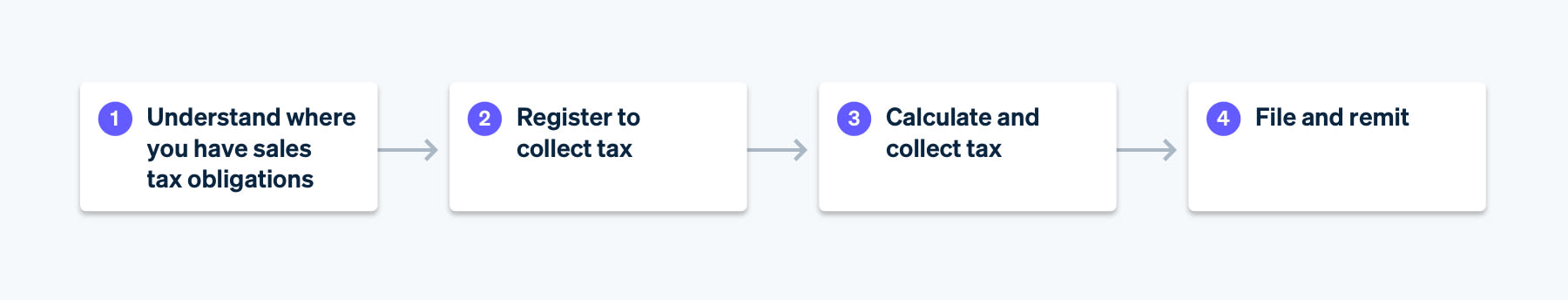

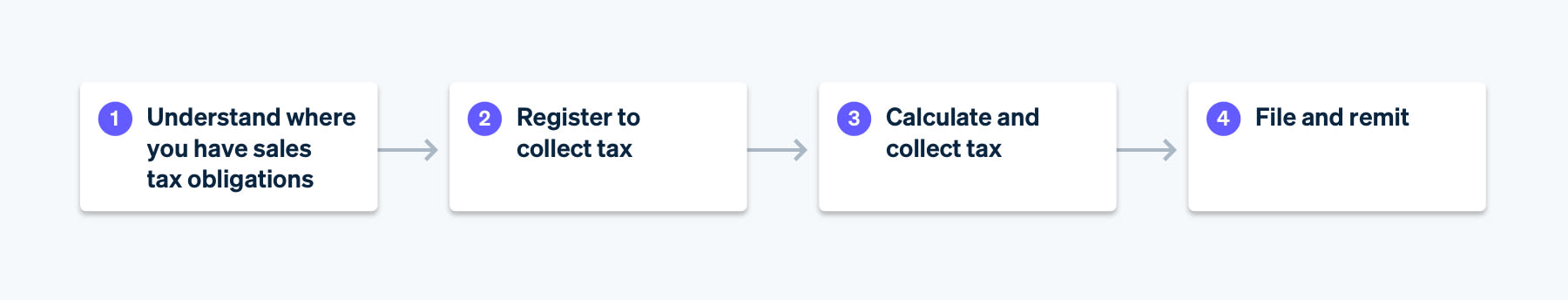

To ensure your business stays tax compliant, you must first understand where you have an obligation to collect tax on your sales and comply with economic nexus laws. Then, you need to follow the sales tax registration process with the appropriate taxing authority; calculate and collect the right amount of tax from your customers; and finally, file your return and remit the tax collected to the government.

Accurately preparing and filing your tax returns and remitting the tax collected can be complicated, as each US state and other local-level taxing authorities have different rules, such as how frequently you need to file, the type of information you need to provide, the form to use, how to submit your tax return and payment, and other administrative differences.

This guide provides in-depth information on filing sales tax returns in the US, including specific instructions for how to file in each US state with a state sales tax.

The basics of filing and remittance

Sales tax is a type of indirect tax. Indirect taxes apply to the sales of goods or services paid for by the customer to a business, which in turn has to pay the tax collected to the state or other local tax authority. This is why sales tax is often referred to as a “pass-through tax.” The tax moves from the customer or buyer to the seller, who then remits the tax collected to the taxing authority. It is important to remember that you, the business, are acting as an agent of the state or other local tax authority, meaning you are holding the funds from the tax collected on behalf of the taxing authority and must remit or pay the amount collected when you file your return. Filing is the act of submitting a sales tax return or report of your sales activity for a period, while remittance is submitting the tax collected to appropriate government entities.

In most situations, your tax payment (remittance) is due at the same time your tax returns and reports are due. Filing and remittance are often coupled together, but it’s important to keep in mind that they are two separate activities.

Your filing and remittance frequency is unique to your business and is set by the state or other local tax authority when you register to collect tax. High-volume businesses are often required to file more frequently than small businesses, so your frequency can change as your business grows.

Filing a sales tax return

Filing a return involves reporting in summary your sales transactions for the reporting period, including amounts you collected from your customers. A return, depending on the form requirements, details information including your gross sales, deductions including nontaxable and exempt sales, taxable sales, and the amount of tax collected. Reported amounts may also be required to be itemized by lower-level jurisdictions or by reporting location.

Each state or local tax authority determines the specific details, format, and frequency required for reporting and filing taxes. For example, some states in the US require businesses to report sales by city, county, or special taxing district when filing. There are other states that only require information at a consolidated or state level. Having accurate, detailed, and updated records is crucial for maintaining tax compliance and will be helpful when it is time to file a tax return, or in the event of an audit.

Key notes on filing

- Filing frequency: Filing frequency is set by the taxing authority and is provided to businesses when they register to collect tax. Filing frequencies can change depending on annual revenue and other factors. You might be required to remit tax monthly, annually, or another set frequency.

- Zero returns: Even if you didn’t collect tax in an area during a certain reporting period, you may still be required to file a tax return. Be prepared to file tax returns by the due date for every reporting period, regardless of sales made during the period. If you continue to file zero returns, you might be notified by the taxing authority that you are no longer required to file a return. Until you receive a change in frequency notice, you should stick to your filing schedule.

- Exemptions: Businesses should consider deductions and exemptions when completing their sales tax filings. These vary by location, but some common types of deductions include resale exemptions, tax exempt products, sales where taxes were collected by marketplace facilitators, and sales to exempt organizations. Not every sale will require you to collect tax from a customer, but you will need to be aware of those exemptions before submitting their sales tax returns.

- Home rule states: Home rule states allow individual home rule cities to administer their own sales taxes as well as define their own tax bases. These cities can define their own tax rules, and sellers may be required to complete additional registrations and filings in these areas. The following are home rule states: Alabama, Alaska, Arizona, Colorado, and Louisiana.

Remittance

While filing is reporting the tax that was collected, remittance is taking the tax collected and transferring it to the state or other local tax authority. Similar to filing, each tax authority mandates their own method and timing of remittance, which may vary depending on your volume of sales in that location. For example, in Connecticut, the frequency varies between monthly, quarterly, and yearly based on total tax liability. With a few exceptions, tax is commonly due with filing.

- Due dates: Ensure your tax payments are submitted by the due date to avoid having to pay penalties and interest.

- Payment methods: Certain taxing authorities only allow electronic payments like ACH, EFT (electronic funds transfer), or credit and debit card payments.

- Extensions and relief measures: As was the case during the pandemic, many states released tax relief measures to give businesses more time to file and remit sales tax. During natural disasters or other major disruptions, this is a common practice, and details on the relief are released by the state taxing authority.

How to file and remit sales tax returns by state

To file and remit taxes, you need to submit returns to each taxing authority where you are registered and have collected taxes. Most areas require online submissions of tax returns and electronic payments, though some will allow businesses to physically mail their documents.

Alabama

The Alabama Department of Revenue requires that sellers file and remit sales tax online. You can file online at My Alabama Taxes (MAT). However, if you are remitting more than $750 in one payment, Alabama requires you to pay via electronic funds transfer (EFT) through My Alabama Taxes ONE SPOT.

Alaska

Arizona

Sellers have two options for filing and remitting their Arizona sales tax (referred to as the transaction privilege tax in Arizona):

- File online at the Arizona Department of Revenue.

- File by mail using Form TPT-EZ if you live in state, or TPT-2 if you live out of state. However, sellers are required to file and pay online if their tax liability in the previous year was $1,000,000 or more.

Arkansas

Sellers have two options for filing and remitting their Arkansas sales tax:

- File online at the Arkansas Taxpayer Access Point (ATAP).

- File by mail using the Form ET-1. To file this way you must contact the Arkansas Department of Finance and Administration at 501-682-7104 and a Form ET-1 will be mailed to you. Here are instructions for filling out Arkansas sales tax Form ET-1.

California

Sellers have two options for filing their California sales tax:

- File online through the California Department of Tax and Fee Administration.

- File by mail using California’s Short Form—Sales and Use Tax Return. You must pay online if your estimated monthly tax liability is $10,000 or more.

Colorado

Sellers have two options for filing their Colorado sales tax:

- File online at the Colorado Department of Revenue.

- File by mail using Form DR-0100 and mail it in to the Colorado Department of Revenue.

Connecticut

District of Columbia

Sellers have two options for filing and remitting their Washington, DC sales tax:

- File online with MyTax DC.

- File by mail using one of three forms:

- Annual filers form: Form FR-800A

- Quarterly filers form: FR-800Q

- Monthly filers form: FR-800M

Florida

Sellers have two options for filing and remitting their Florida sales tax:

- File online at the Florida Department of Revenue.

- File by mail by using Form DR-15.

Georgia

Sellers have two options for filing and remitting their Georgia sales tax:

- File online at the Georgia Department of Revenue.

- File by mail using Form ST-3.

Hawaii

Idaho

Sellers have two options to file and remit their Idaho sales tax:

- File online at the Idaho State Tax Commission’s Taxpayer Access Point (TAP).

- File by mail using Form 850. The state tax commissioner must mail you a personalized Form 850.

Illinois

Sellers have two options to file and remit their Illinois sales tax:

- File online at MyTax Illinois.

- File by mail using Form ST-1.

Indiana

Iowa

Kansas

Sellers have two options to file and remit their Kansas sales tax:

- File online at the Kansas Department of Revenue. If you’ve never used this system before, you may have to contact the Kansas Department of Revenue for your access code.

- Single jurisdiction filers should use Form ST-16 to file by mail. Form ST-36 should be used for multiple jurisdiction filers to file by mail. Form CT-9U can also be used.

Kentucky

Louisiana

Depending on the type of license a seller has and whether they are a remote seller or based in Louisiana, they will file one of three ways:

- Online through E-Parish.

- Online through Remote Sellers Filing.

- Online at the Louisiana Taxpayer Access Point.

Maine

Sellers have two options to file and remit their Maine sales tax:

- File online through the Maine Tax Portal.

- File by mail using Form ST-7.

Maryland

Massachusetts

Sellers have two options for filing and remitting their Massachusetts sales tax:

- File online at the Massachusetts Department of Revenue. Businesses with more than $5,000 in tax liability must use this method to file.

- File by mail using Form ST-9.

Michigan

Sellers have two options for filing and remitting their Michigan sales tax:

- File online at the Michigan Treasury Online.

- File by mail using Form 5080. This form is only applicable for monthly or quarterly filers.

Minnesota

Sellers have two options for filing and remitting their Minnesota sales tax:

- File online at the Minnesota Department of Revenue.

- File by phone by calling the revenue department at 1-800-570-3329. However, if you have a sales and use tax liability of $10,000 or more in the state’s fiscal year (July 1–June 30), you must pay all taxes electronically beginning with the next calendar year.

Mississippi

Missouri

Sellers have two options for filing and remitting their Missouri sales tax:

- File online at the Missouri Department of Revenue. If filing from out of state, choose “Vendor’s Use Tax.” High-volume sellers who have made payments of $8,000 or more in the prior tax year are required to file online. In some cases, quarterly filers may be required to pay online, too.

- File by mail using Form 53-1. The Missouri Department of Revenue will issue you this form. You will not receive paper returns in the mail if you have previously filed electronically unless you contact the department and request future paper returns.

Nebraska

Sellers have two options for filing and remitting their Nebraska sales tax:

- File online at the Nebraska Department of Revenue. You will remit your payment through Nebraska E-Pay.

- File by mail using Form 10.

Nevada

Sellers have two options to file and remit their Nevada sales tax:

- File online at the Nevada Department of Taxation.

- File by mail using Form TXR-01.01c.

New Jersey

Sellers have two options to file and remit their New Jersey sales tax:

- File online at the New Jersey Division of Taxation.

- File by mail using Form ST-50.

New Mexico

- File online using E-File.

- File by mail using the Gross Receipts Tax Return.

New York

North Carolina

Sellers have two options to file and remit their North Carolina sales tax:

- File online at the North Carolina Department of Revenue.

- File by mail using this tax return form.

North Dakota

Ohio

Oklahoma

Sellers have two options to file and remit their Oklahoma sales tax:

- File online at OK Tap.

- Use form STS-20002 to file by mail. Keep in mind that filers who pay more than $2,500 per month are required by Oklahoma to file online.

Pennsylvania

Sellers have two options to file and remit their Pennsylvania sales tax:

- File online at the Pennsylvania Department of Revenue.

- File over the telephone at 1-800-748-8299.

Rhode Island

Sellers have two options to file and remit their Rhode Island sales tax:

- File online at the Rhode Island Division of Taxation.

- Pay through the mail by using the Rhode Island Streamlined Sales Tax Return. Sellers must file and pay online if your tax liability in the previous year was $200 or more.

South Carolina

South Dakota

Tennessee

Sellers have two options for filing and remitting their Tennessee sales tax:

- File online at the Tennessee Department of Revenue.

- File by mail using Form SLS-450.

Texas

Sellers have two options for filing and remitting their Texas sales tax:

- File online at the TxComptroller eSystems site.

- File by mail using a Texas sales and use tax return.

Utah

Sellers have two options for filing and remitting their Utah sales tax:

- File online at the Utah Taxpayer Access Point (TAP).

- Sellers can also choose to file by mail. After a sales tax license has been issued, the Tax Commission will mail a personalized return to each seller, unless the seller has elected to not receive paper returns. If a seller does not receive a paper return, it is the seller’s responsibility to obtain blank forms, file all appropriate return forms, and remit taxes by the due date. All the relevant forms are listed on the state website.

Vermont

Sellers have two options for filing and remitting their Vermont sales tax:

- File online using myVTax portal.

- File by mail and send in a payment to: Vermont Department of Taxes PO Box 1779, Montpelier, VT 05601-1779.

Virginia

Sellers have two options for filing and remitting their Virginia sales tax:

- File and remit through the Virginia Department of Taxation’s VATAX Online Service for Business.

- File by mail using Form ST-8 (for out-of-state sellers) or ST-9 (for in-state sellers with one location).

Washington

Sellers have two options for filing and remitting their Washington sales tax:

- File online at the Washington Department of Revenue.

- You can use various forms to file and pay through the mail.

West Virginia

Sellers have two options for filing and remitting their West Virginia sales tax:

- File online at MyTaxes.

- File by mail using Form CST200CU.

Wisconsin

Sellers have two options to file and remit their Wisconsin sales tax:

- File online at the Wisconsin Department of Revenue.

- File by mail using Form ST-12.

Wyoming

Sellers have two options to file and remit their Wyoming sales tax:

- File online by using the Wyoming Internet Filing System for Businesses (WYIFS).

- File by mail using Form 41-1.

How Stripe can help

Filing taxes is complex and time-consuming. Stripe Tax creates detailed reports and tax summaries for each filing location, providing all the information you need to file and remit taxes manually, with an accounting professional, or with a Stripe filing partner.

- Understand where to register and collect taxes: See where you need to collect taxes based on your Stripe transactions and, after you register, switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe’s no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: Stripe Tax provides links to the websites where you can register once you exceed the threshold to register.

- Automatically collect tax: Stripe Tax always calculates and collects the correct amount of tax, no matter what or where you sell. It supports hundreds of products and services, and is up to date on tax rule and rate changes.

- Simplify filing and remittance: Stripe generates itemized reporting and tax summaries for each filing location, helping you easily file and remit taxes on your own, with your accountant, or with one of Stripe’s filing partners.

Read our docs to learn more or set up Stripe Tax today.